Trying to make your crypto earn more without constantly moving funds can feel like chasing a moving target. Yield aggregators are the shortcut many traders use. They automatically shuffle assets between the highest‑yielding protocols, handling the math, gas costs, and timing for you. This guide breaks down exactly how they work, what you should watch out for, and how to start using one today.

Quick Takeaways

- Yield aggregators automate the search for the best APY across multiple DeFi protocols.

- They rely on smart contracts that rebalance assets, pay gas, and manage risk.

- Key risks include smart‑contract bugs, volatile slippage, and hidden fees.

- Popular platforms (Yearn, Beefy, Autofarm) differ in chain support, fee structures, and strategy complexity.

- Start small, monitor performance regularly, and use reputable aggregators with audited code.

What Is a Yield Aggregator?

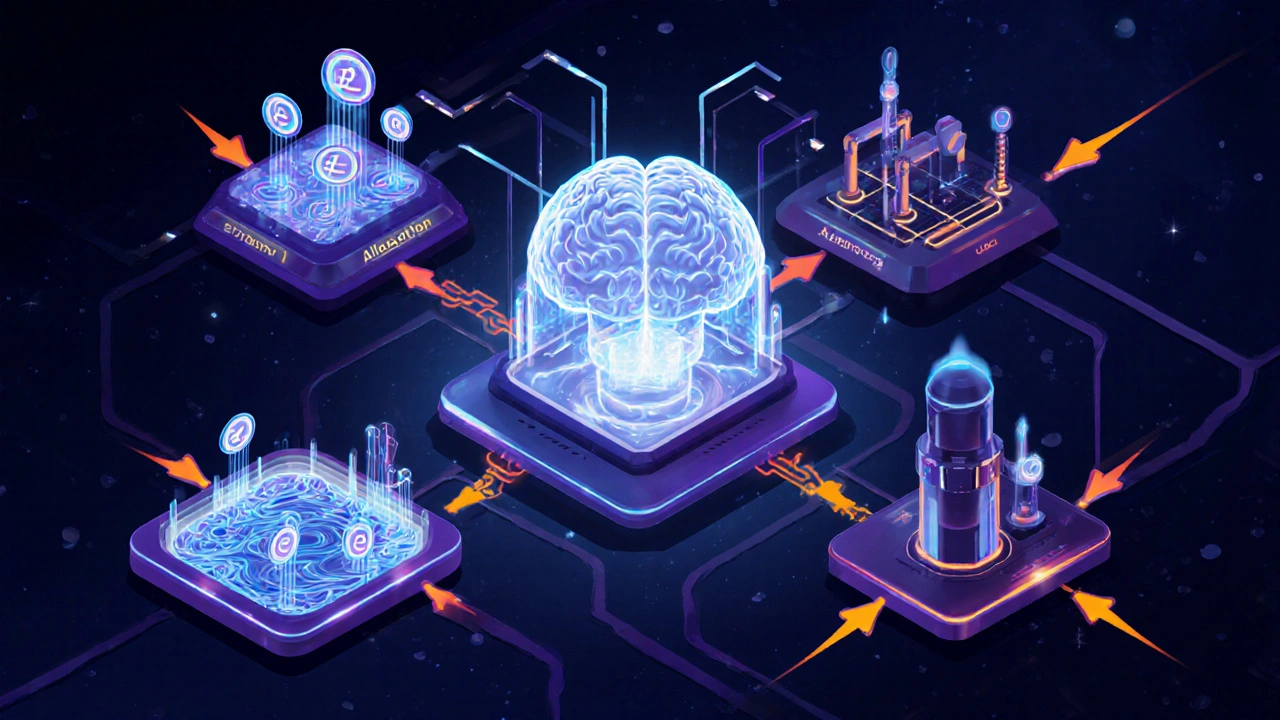

Yield aggregator is a type of decentralized service that automatically allocates deposited tokens to the most profitable yield farming opportunities. It sits on top of Decentralized Finance (DeFi), using on‑chain logic to chase the highest annual percentage yields (APY) while handling the complex timing of deposits, withdrawals, and compounding.

The idea is simple: instead of manually scanning dozens of protocols, you deposit into a single vault, and the aggregator’s smart contract does the heavy lifting. The contract continuously monitors the market, moves funds to new farms, and compounds rewards, all while you keep ownership of the underlying tokens.

How Do Yield Aggregators Work?

At the core is a smart contract that lives on a blockchain. The contract follows three basic steps:

- Discovery: It reads price oracles and on‑chain data to rank farms by net APY after accounting for fees and gas.

- Allocation: It transfers assets from its vault to the chosen protocol’s liquidity pool or staking contract.

- Rebalancing: Periodically, the contract checks if another farm now offers a higher net return and, if so, executes a swap via an automated market maker (AMM) to move the capital.

Every move incurs gas fees, so the aggregator includes a profitability threshold. If the gain from switching farms doesn’t cover gas, the contract stays put. This keeps the strategy efficient even when network congestion spikes.

Core Components and Their Roles

Understanding the building blocks helps you gauge safety and performance.

- Vault Contract: Holds user deposits and issues a receipt token representing your share.

- Strategy Contracts: Modular pieces that define how to interact with a specific farm (e.g., deposit LP tokens, claim rewards, auto‑compound).

- Price Oracles: Off‑chain or on‑chain feeds (Chainlink, Band) that provide real‑time token prices for APY calculations.

- Governance Token: Many aggregators reward users with their native token (e.g., YFI, BIFI) that can be staked for extra boosts.

- Risk Management: Some platforms add insurance wrappers or set maximum exposure per protocol to limit loss from a single smart‑contract exploit.

Each component interacts via smart contracts, making the entire system trustless but also dependent on code quality.

Benefits and Risks

Why use an aggregator? The upside is obvious: higher returns with less manual effort. You also gain exposure to multiple strategies without owning each LP token, simplifying tax reporting.

But there are trade‑offs.

| Benefit | Risk |

|---|---|

| Automated compounding boosts APY. | Smart‑contract bugs can drain vault funds. |

| Single entry point reduces transaction count. | Gas spikes can eat a significant portion of earnings. |

| Diversification across farms lowers protocol‑specific risk. | Hidden fees (performance fee, withdrawal fee) cut net returns. |

| Governance token incentives add extra yield. | Token price volatility can turn "extra" yield into loss. |

Assess each aggregator’s audit history, fee transparency, and community reputation before committing large sums.

Step‑By‑Step: Using a Yield Aggregator

- Choose a platform. Look at chain support, audited contracts, and fee structure.

- Connect your wallet. Most aggregators work with MetaMask, Trust Wallet, or Ledger.

- Select a vault. Pick the token you want to deposit (e.g., ETH, USDC) and read the strategy description.

- Approve the token. The UI will prompt an ERC‑20 approval transaction; this costs a one‑time gas fee.

- Deposit. Enter the amount and confirm. You’ll receive a receipt token representing your share.

- Monitor performance. Dashboards show net APY, accumulated rewards, and any pending rebalances.

- Withdraw. When you’re ready, click “Withdraw”. The contract swaps any LP tokens back to the base asset and sends them to your wallet.

Keep an eye on the “gas budget” setting if the platform offers it - lowering it reduces costs during high‑traffic periods but may delay rebalancing.

Popular Yield Aggregators - Quick Comparison

| Platform | Supported Chains | Performance Fee | Strategy Types | Notable Feature |

|---|---|---|---|---|

| Yearn.finance | Ethereum, Arbitrum, Optimism | 5% of net profit | Stablecoin, LP, Single‑Asset | Governance token (YFI) boosts via ve‑YFI |

| Beefy.Finance | 20+ chains (BSC, Polygon, Avalanche) | 4.5% + 0.1% withdrawal | Cross‑chain vaults, auto‑compound | Universal vault interface, no code changes for new chains |

| Autofarm.network | Ethereum, BSC, Fantom, Cronos | 3% (lower for $AFARM holders) | Liquidity mining, single‑sided staking | Native token rewards & staking rewards pool |

| Harvest Finance | Ethereum, Polygon | 6% + possible withdrawal tax | Yield farms, synthetic assets | Insurance fund for partial loss protection |

Pick the one that matches your preferred chain and risk appetite. If you care about low fees, Autofarm’s 3% model shines. For broad exposure across many blockchains, Beefy’s multi‑chain vaults are a win.

Best‑Practice Checklist

- Verify that the vault contract is audited by a reputable firm (e.g., OpenZeppelin, ConsenSys).

- Start with a modest amount (5‑10% of your portfolio) to test the workflow.

- Watch the slippage setting - high slippage can cause worse-than‑expected swaps.

- Consider the impact of gas fees; during network spikes, some aggregators pause rebalancing.

- Keep an eye on the platform’s governance proposals - fee changes or strategy tweaks are often decided by token holders.

- Use a hardware wallet for large deposits to prevent key exposure.

- Regularly review the vault’s net APY versus the baseline protocol’s APY; a narrowing gap may signal inefficiency.

Frequently Asked Questions

Do I lose ownership of my tokens when I deposit into a vault?

You receive a receipt token (often called a vault share token) that represents your proportional claim on the underlying assets. As long as the smart contract is sound, you can redeem the receipt token for the original asset plus any earned yield.

How often do aggregators rebalance my position?

Rebalancing frequency varies by platform and by gas cost. Some run every few hours, others wait until a profitability threshold is met. Most allow you to set a custom gas‑budget or rebalance trigger in the UI.

Are the yields guaranteed?

No. Yield comes from the underlying protocols, which can change rates, suffer exploits, or experience liquidity crashes. Aggregators only aim to capture the highest *available* APY at any moment.

What’s the difference between a yield aggregator and a regular yield farm?

A regular farm requires you to manually deposit tokens into a single protocol and claim rewards yourself. An aggregator automates that process across many farms, constantly shifting capital to chase the best net returns.

Can I earn the aggregator’s native token on top of the base APY?

Many aggregators reward users with their governance token (e.g., YFI, BIFI). Holding or staking that token often provides a boost to your base yield, but token price volatility can affect overall profitability.

Next Steps & Troubleshooting

If a rebalance transaction fails, check the current gas price on the network. Most wallets let you manually increase the gas limit. A common mistake is forgetting to approve the token before depositing - the contract can’t pull funds, and you’ll see a “transaction reverted” error.

For persistent underperformance, compare the vault’s net APY with the raw protocol’s APY. If the gap is large, the aggregator might be paying high fees or suffering from stale oracle data. In such cases, consider moving to a different platform or a direct farm.

Finally, keep a backup of your receipt token’s contract address. In the unlikely event the aggregator shuts down, you can still interact with the contract directly to withdraw your share.